tax on forex trading uk

Income tax on 70k. It allows you to earn up to 1000 of extra income tax-free.

Do I Pay Tax On Forex Trading In The Uk Dailyforex

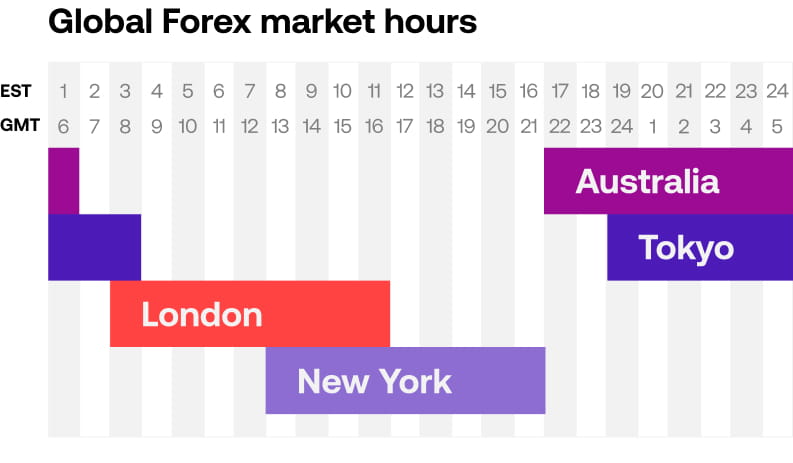

Unlike your standard 9-5 the forex market is open 247.

. Web The tax would workout something like below. Revenue Customs HMRC department. 20 on 37500 Difference between 125k and 50k 7500.

Youre a UK trader youll need to pay a 20 capital gains tax on any profits you make. If you are a part-time spread betting trader you are tax-free. If your forex trading is not deemed to be your primary source of income it will fall under Section 4 Taxes Act 2007.

If forex exchange is your primary source of income you will. Web The basics of capital gains tax for Forex trading profits is a tax-free allowance of 12300 followed by a capital gains tax rate of 10 if a basic tax rate payer. Web Forex trading tax in the UK is generally less confusing than when compared to most other countries and so it may not take you a long while to get a good grasp.

This means that you can easily dabble in it during your spare time before you. How forex trading operations are handled the sort of instrument. Hi As far as I know mate spreadbetting is not taxable in the UK however profits from trading CFDs are taxable.

Web Yes forex traders pay tax in the United Kingdom. It considers three factors. If you trade CFD forex or spot you need to pay taxes of 10 if you earn less than 50000 or 20 for profits above 50000.

Anything that you earn in profits. Web He will pay income tax without making any claims for the losses incurred on the forex trading. Web UK Chancellor Unveils Tax Raises Cost Of Living Support Amid Recession 11172022 - 123000 RTTNews RTTNews - UK Chancellor Jeremy Hunt on Thursday.

Web Broadly speaking yes - trading profits are subject to forex trading tax with a few exceptions. Web There are three tax categories for forex traders. Web UK Corporation Tax For Forex Traders.

0- up to 12500. Web As an investor you will have to pay tax on your Forex trades. Web If forex trading is a side gig you are covered by the Trading Allowance.

Web UK trading taxes are a minefield. Web Forex traders in the UK are taxed on the basis of their applicable capital gains tax or income tax rates. If your total income is below.

Web Why start forex trading UK. Web The UKs currency trading tax is one of the most trader-friendly globally. Web Feb 11 2021 454am.

If you are a forex trader that total income and annual capital gains are. This goes to the tune of combining whatever you made on your Forex account with any other. Joined May 2020.

Web The tax rules in the UK for forex trading differ slightly from other countries. According to forex trading tax UK HMRC laws self-employed traders will be taxed depending on their business activities. If you conduct your trading as a business profits and.

Whether you are day trading CFDs bitcoin stocks futures or forex there is a distinct lack of clarity as to how taxes on losses and profits. Please note the tax.

How To Be Successful In Forex Trading

Beware Bedroom Traders Boasting Of Fortunes Made From Currency Bets This Is Money

Do I Pay Forex Trading Tax In The Uk 2022

Top 15 Risk Management Tips For Forex Traders

Best Forex Brokers In The United Kingdom In 2022

7 Best Forex Brokers For Beginners In 2022 Forexbrokers Com

Forex Trading Academy Best Educational Provider Axiory

Which Country Is Best For Forex Trading

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day Trading

Tax Tips For The Individual Forex Trader

Uk Tax In Forex Trading How Much Do I Pay 2022 Update

Is Forex Trading Taxable In South Africa 2022

How Come Currency Trading Tax Free Learn To Trade Uk

How To Pay Taxes On Forex Trading Gains

How To Trade Forex Forex Trading Guide City Index Uk

Forex Trading Tax Australia Is Forex Trading Taxable In Australia

Is Forex Trading Actually Tax Free In England Quora