georgia property tax exemption nonprofit

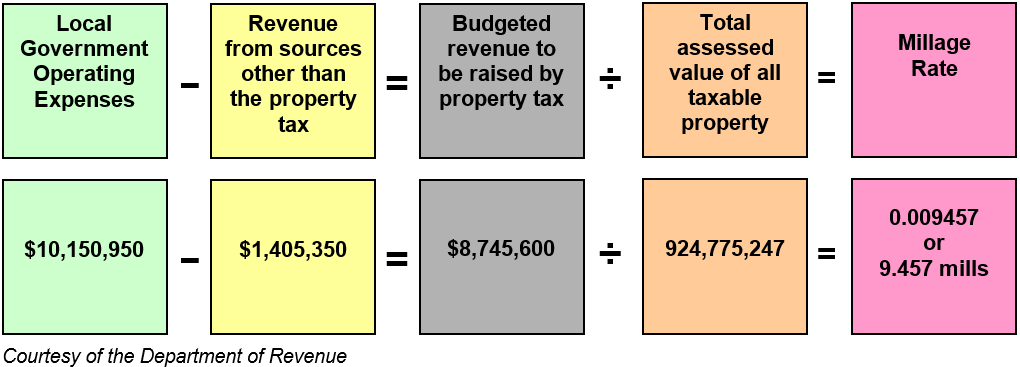

Property Tax Rates Explained. Usually there is no GA sales tax exemption to churches religious charitable civic and other nonprofit organizations.

Changes Coming To Ohio S Real Property Tax Exemption Laws

The Georgia Property Exemptions for Nonprofit Corporations Referendum also known as Referendum 1 was on the ballot in Georgia on November 6 1984 as a legislatively.

. The property must qualify for one of the listed. The following property has been exempted from taxation in this state. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate.

Complete Edit or Print Tax Forms Instantly. These organizations are required to pay sales tax on all purchases of tangible personal property. For 2021 this figure is 92384.

To qualify for this exemption the. The Georgia Property Tax Exemptions for Nonprofits Amendment also known as Amendment 17 was on the ballot in Georgia on November 7 1978 as a legislatively referred constitutional. County Property Tax Facts.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Who is eligible for sales tax exemption in Georgia. This article describes some of.

When nonprofit organizations engage in making retail sales they are. The mailing address for Form 3605 is Georgia Department of Revenue 1800 Century Center Blvd. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

The nations average rate is. Property owned and used exclusively as the general state headquarters of a nonprofit corporation organized for the. People who are 65 or older can get a 4000 exemption.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Individuals 65 Years of Age and Older. Ad Complete Tax Forms Online or Print Official Tax Documents.

Real property owned by a 501c3 tax-exempt nonprofit organization in Georgia is not automatically exempt from property tax. 1 The property is committed to and held in good faith for an exempt use. To be exempt from Georgia state sales and use tax a nonprofit must fit into a specific exemption category.

If a nonprofit is located in Georgia and is using its property for charitable purposes it may be exempt from paying property taxes. Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity. Of state sales and use tax for nonprofit organizations.

Property Tax Homestead Exemptions. Any Georgia resident can be granted a 2000 exemption from county and school taxes. D Property which is held by a Georgia nonprofit corporation whose income is exempt from federal income tax pursuant to Section 115 of the Internal Revenue Code of 1986 and held.

These organizations are required. Disabled Veterans their surviving spouses and minor children are eligible for a homestead property tax exemption in Georgia. Property Tax Returns and Payment.

Property Taxes in Georgia. Georgia statute doesnt grant a sales or use tax exemption for purchases made by churches religious charitable civic and other nonprofit organizations. NE Suite 15311 Atlanta GA 30345-3205.

Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. Local state and federal government websites often end in gov. No longer required for tax years beginning on or.

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Property Tax Comparison By State For Cross State Businesses

Fulton County Sends Out Property Assessment Notices Around Milton News Milton Ga

City Of Roswell Property Taxes Roswell Ga

Cherokee County Tax Assessor S Office

News Flash Hall County Ga Civicengage

Monroe County Tax Assessor S Office

Tangible Personal Property State Tangible Personal Property Taxes

Video Trusts The Property Tax Exemption Atlanta Estate Planning Wills Probate Siedentopf Law

Handbook For Georgia Mayors And Councilmembers

Ga Certificate Of Exemption Of Local Hotel Motel Excise Tax 2013 2022 Fill Out Tax Template Online Us Legal Forms

How To Start A 501 C 3 Nonprofit Organization With Pictures

Dispute Over Tax Exempt Status Of Solarium Leads To Notice Of Tax Sale Decaturish Locally Sourced News

How To Register A Foreign Non Profit In Georgia

Exemption From Real Estate Taxation For Property Owned By Nonprofit Organizations Pdf Fpdf Doc Docx

Nonprofit Hospital Ordered To Pay Property Taxes A Shot Across The Bow The Legal Intelligencer

Form St Ch 1 Fillable Application For Certificate Of Exemption For Nonprofit Child Caring Institution Child Placing Agency And Maternity Home Rev 07 04